The Romanian wiki is no longer maintained and is in read-only mode. Information contained within may be inaccurate or outdated. Please go to the English wiki for more up to date information.

Traducere automată din engleză: wiki-ul românesc nu mai este întreținut și este în modul doar citire. Informațiile conținute în interior pot fi inexacte sau depășite. Vă rugăm să accesați wiki-ul în engleză pentru mai multe informații actualizate.

Intrebari Frecvente: Diferență între versiuni

FiR3 (discuție | contribuții) traducerea secțiunii Pot cumpăra bitcoini cu Paypal? |

|||

| Linia 52: | Linia 52: | ||

=== Pot cumpăra bitcoini cu Paypal? === | === Pot cumpăra bitcoini cu Paypal? === | ||

Este posibilă cumpărarea bitcoinilor fizici cu PayPal, dar este dificilă și/sau scumpă această operațiune pentru bitcoinii non-fizici, datorită riscului signifiant pentru vânzător | |||

Deși este posibilă găsirea unui individ ce dorește să-ți vândă Bitcoini via PayPal (posibil via [http://www.bitcoin-otc.com/ #bitcoin-otc]), majoritatea schimburilor virtuale nu permit finanțarea prin PayPal. Acest lucru se datorează cazurilor repetate în care cineva plătește bitcoinii prin PayPal, își primește bitcoinii cuveniți, iar mai apoi se plânge în mod fraudulos către PayPal pe motiv că nu și-ar fi primit achiziția. PayPal adesea ia partea cumpărătorului fraudulos în acest caz, ce-nseamnă că orice vânzător trebuie să-și acopere riscul cu taxe mai mari sau să refuze să accepte PayPal cu totul. | |||

Cumpărarea de Bitcoini de la indivizi în acest fel este posibil, dar este necesar ca vânzătorul să aibă încredere că acel cumpărător nu va depune o cerere către PayPal de restituire a plății. | |||

=== Unde pot găsi un forum dedicat discuțiilor despre Bitcoin? === | === Unde pot găsi un forum dedicat discuțiilor despre Bitcoin? === | ||

Versiunea de la data 25 ianuarie 2014 12:26

Aici veți găsi răspunsuri la majoritatea întrebărilor frecvente.

General

Ce sunt bitcoinii?

- Bitcoin-ul este unitatea de monedă a sistemului Bitcoin. O prescurtare utilizată în mod obișnuit pentru această monedă este "BTC", pentru a se referi la un preț sau cantitate (de exemplu: "100 BTC"). Există astfel de lucruri ca Bitcoin fizic, dar în cele din urmă, un Bitcoin este doar un număr asociat cu o Adresă Bitcoin. Un Bitcoin fizic este pur și simplu un obiect, cum ar fi o monedă, cu numărul atent integrat în interior.

- A se vedea, de asemenea, o introducere ușoară pentru Bitcoin.

Cum fac rost de bitcoini?

- Există o varietate de moduri de a dobândi Bitcoins:

- Acceptă Bitcoin ca plată pentru bunuri sau servicii.

- Cel mai obișnuit mod de a cumpăra Bitcoin sunt Bitcoin Exchanges

- Există mai multe servicii, unde poți trade them pentru monezi tradiționale.

- Găsește pe cineva care vinde Bitcoin în persoană pentru cash prin local directory.

- Participă într-un mining pool.

- De asemenea, dacă echipamentul de minerit este destul de performant, minatul solo este posibil prin crearea unui nou block ( Rezolvarea unui block produce în prezent 25 Bitcoin, plus taxele de tranzacție).

- Vizită site-urile care oferă free samples and offers.

Garantează Bitcoin un flux gratis de bani?

- Deoarece Bitcoin este o tehnologie nouă, poate crea confuzie cu privire la ce este și cum funcționează. Uneori, datorită prezentării, este privit ca una dintre următoarele lucruri:

- O schemă "îmbogățește-te peste noapte" online.

- O portiță în piața economiei, prin instalarea sa garantează un flux regulat de cash.

- O investiție sigură care va rezulta aproape întotdeauna un profit.

- De fapt, niciuna dintre scenariile prezentate mai sus sunt adevărate. Să privim cu atenție scenariile în mod independent.

- Este Bitcoin o schemă care poate îmbogății peste noapte ?

- Dacă ai petrecut destul timp pe internet, cel mai probabil ai văzut multe reclame pentru fel și fel de metode care te pot îmbogății peste noapte. Reclamele acestea deobicei oferă profituri imense în schimbul a câteva ore investite. Aceste metode sunt, în majoritatea cazurilor, scheme piramidale care generează bani de la angajații săi proprii și nu oferă nimic în schimb ce reprezintă o valoare reală. Majoritatea lor te vor convinge să cumperi un pachet care îți va câștiga sume în jurul sutelor zilnic, dar defapt prin tine, distribuie reclamă și mai multă. În concluzie rezultând profit pentru cel care deține jocul piramidal.

- Bitcoin este în nici un fel similar cu aceste scheme. Bitcoin nu promite profituri excepționale. Nu există nici o modalitate prin care dezvoltătorii pot face bani cu implicarea ta sau de a lua bani de la tine. Obținerea unui Bitcoin este aproape imposibil fără consimțământul proprietarului. Acest fapt reprezintă un punct forte al monedei virtuale. Bitcoin este o monedă experimentală, virtuală care poate reuși sau poate eșua. Nici unul dintre dezvoltătorii săi se așteaptă să se îmbogățească pe urmă sa.

- Un răspuns mai detaliat la această întrebare poate fi găsit here.

- Voi face bani instalând clientul?

- Majoritatea indivizilor care folosesc Bitcoin nu câștiga nimic prin a face acest lucru. Iar clientul implicit nu a fost creat pentru a câștiga Bitcoin. O mică minoritate de oameni cu hardware dedicat, de înaltă performanță dobândesc Bitcoin prin "mining" (generează bitcoins, vezi What is mining?) cu un soft special, dar aderarea în comunitatea Bitcoin nu ar trebui să fie greșit interpretată ca fiind drumul spre bogăție. Marea majoritate a utilizatorilor se implică pentru că conceptualitatea proiectului este foarte interesantă, prin urmare nu au nimic de câștigat prin asta. Acesta este, de asemenea, motivul pentru care nu veți găsi speculații multe cu privire la repercusiuni politice sau economice legate de Bitcoin oriunde pe acest site: Dezvoltătorii Bitcoin își datorează devotamentul lor pentru beneficiile intelectuale, decât cele de natură monetară. Bitcoin își face primii pași mărunți: poate ajunge într-o poziție unde va crea lucruri grozave, dar acum are ceva de oferit doar celor care au nevoie de un stimulus interesant din punct de vedere conceptual si care face parte din tehnologia de ultima oră.

- Ca o investiție, este Bitcoin un lucru sigur?

- Bitcoin este o monedă electronică nouă și interesantă, valoarea acestuia nu este susținută de către nici un guvern sau organizație. Ca orice valută, o anumită parte din valoare se justifică prin faptul că oamenii sunt dispuși să facă comerț în schimbul bunurilor sau servicilor. Rata de schimb a valutei fluctuează în continuu, și câteodată în mod nesăbuit. Este lipsită de recunoaștere globală și este vunerabil la manipulare de către terți care dispun de o finanțare modestă. Incidente de securitate, cum ar fi compromisul site-urilor sau a conturilor pot declanșa lichidări majore. Diferite fluctuații pot crea o serie de bucle pozitive, acestea cauzând fluctuații mult mai mari al cursului de schimb. Oricine care investește bani în Bitcoin trebuie să înțeleagă riscurile la care sunt predispuși, și să considere valuta un curs de schimb volatil. Odată ce Bitcoin devine mai cunoscut și acceptat, cursul se va stabiliza, dar pentru moment este imprevizibil. Orice investiție în Bitcoin ar trebui făcut cu atenție și cu un plan clar de a mitiga riscul.

Pot cumpăra bitcoini cu Paypal?

Este posibilă cumpărarea bitcoinilor fizici cu PayPal, dar este dificilă și/sau scumpă această operațiune pentru bitcoinii non-fizici, datorită riscului signifiant pentru vânzător

Deși este posibilă găsirea unui individ ce dorește să-ți vândă Bitcoini via PayPal (posibil via #bitcoin-otc), majoritatea schimburilor virtuale nu permit finanțarea prin PayPal. Acest lucru se datorează cazurilor repetate în care cineva plătește bitcoinii prin PayPal, își primește bitcoinii cuveniți, iar mai apoi se plânge în mod fraudulos către PayPal pe motiv că nu și-ar fi primit achiziția. PayPal adesea ia partea cumpărătorului fraudulos în acest caz, ce-nseamnă că orice vânzător trebuie să-și acopere riscul cu taxe mai mari sau să refuze să accepte PayPal cu totul.

Cumpărarea de Bitcoini de la indivizi în acest fel este posibil, dar este necesar ca vânzătorul să aibă încredere că acel cumpărător nu va depune o cerere către PayPal de restituire a plății.

Unde pot găsi un forum dedicat discuțiilor despre Bitcoin?

Please visit the [Portal] for links to Bitcoin-related forums.

Cum se creează noi bitcoini?

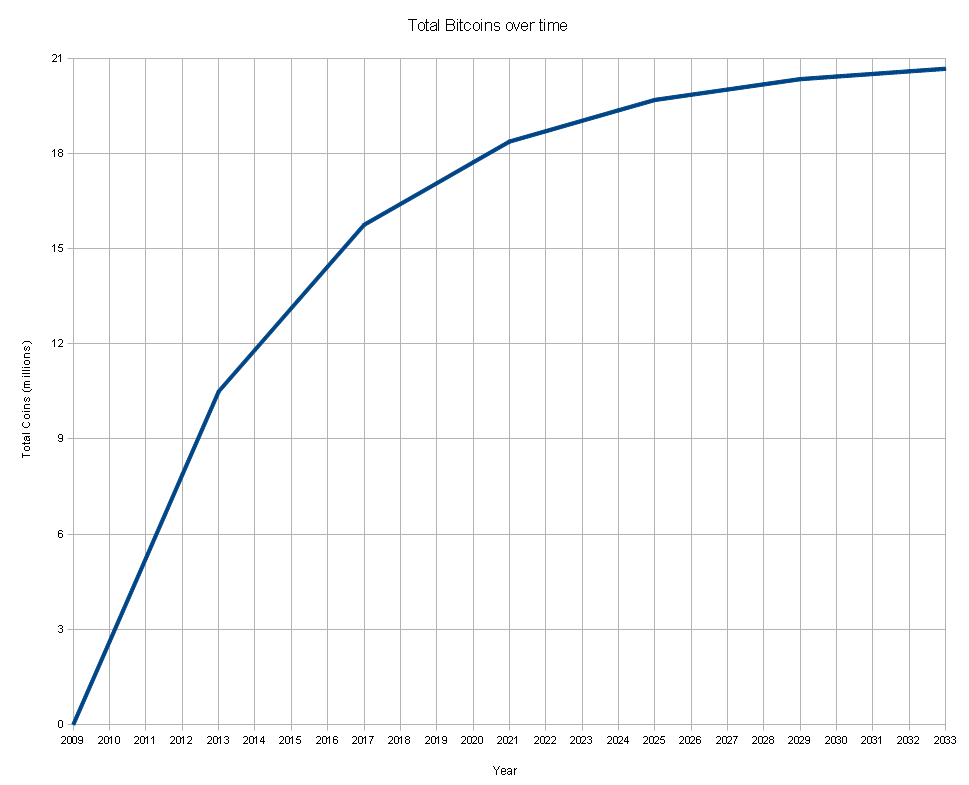

New bitcoins are generated by the network through the process of "mining". In a process that is similar to a continuous raffle draw, mining nodes on the network are awarded bitcoins each time they find the solution to a certain mathematical problem (and thereby create a new block). Creating a block is a proof of work with a difficulty that varies with the overall strength of the network. The reward for solving a block is automatically adjusted so that roughly every four years of operation of the Bitcoin network, half the amount of bitcoins created in the prior 4 years are created. 10.500.000 bitcoins were created in the first 4 (approx.) years from January 2009 to November 2012. Every four years thereafter this amount halves, so it will be 5.250.000 over years 4-8, 2.625.000 over years 8-12, and so on. Thus the total number of bitcoins in existence will never exceed 21.000.000. See Controlled Currency Supply.

Blocks are mined every 10 minutes, on average and for the first four years (210.000 blocks) each block included 50 new bitcoins. As the amount of processing power directed at mining changes, the difficulty of creating new bitcoins changes. This difficulty factor is calculated every 2016 blocks and is based upon the time taken to generate the previous 2016 blocks. See Mining.

Care este numărul total de bitcoini la ora actuală?

Current count. Also see Total bitcoins in circulation chart

The number of blocks times the coin value of a block is the number of coins in existence. The coin value of a block is 50 BTC for each of the first 210.000 blocks, 25 BTC for the next 210.000 blocks, then 12.5 BTC, 6.25 BTC and so on.

Cât de divizibili sunt bitcoinii?

A bitcoin can be divided down to 8 decimal places. Therefore, 0.00000001 BTC is the smallest amount that can be handled in a transaction. If necessary, the protocol and related software can be modified to handle even smaller amounts.

Cum se numesc denominările bitcoinului?

There is a lot of discussion about the naming of these fractions of bitcoins. The leading candidates are:

- 1 BTC = 1 bitcoin

- 0.01 BTC = 1 cBTC = 1 centibitcoin (also referred to as bitcent)

- 0.001 BTC = 1 mBTC = 1 millibitcoin (also referred to as mbit (pronounced em-bit) or millibit or even bitmill)

- 0.000 001 BTC = 1 μBTC = 1 microbitcoin (also referred to as ubit (pronounced yu-bit) or microbit)

The above follows the accepted international SI prefixes for hundredths, thousandths, and millionths. There are many arguments against the special case of 0.01 BTC since it is unlikely to represent anything meaningful as the Bitcoin economy grows (it certainly won't be the equivalent of 0.01 USD, GBP or EUR). Equally, the inclusion of existing national currency denominations such as "cent", "nickel", "dime", "pence", "pound", "kopek" and so on are to be discouraged; this is a worldwide currency.

One exception is the "satoshi" which is smallest denomination currently possible

- 0.000 000 01 BTC = 1 satoshi (pronounced sa-toh-shee)

which is so named in honour of Satoshi Nakamoto, the pseudonym of the inventor of Bitcoin.

For an overview of all defined units of Bitcoin (including less common and niche units), see Units.

Further discussion on this topic can be found on the forums here:

Cum funcționează înjumătățirea când numărul devine foarte mic?

Eventually the reward will go from 0.00000001 BTC to zero and no more bitcoins will be created.

The block reward calculation is done as a right bitwise shift of a 64-bit signed integer, which means it is divided by two and rounded down. The integer is equal to the value in BTC * 100,000,000 since internally in the reference client software, all Bitcoin balances and values are stored as unsigned integers.

With an initial block reward of 50 BTC, it will take many 4-year periods for the block reward to reach zero.

Cât timp va dura până vor fi generate toate monezile?

The last block that will generate coins will be block #6,929,999 which should be generated at or near the year 2140. The total number of coins in circulation will then remain static at 20,999,999.9769 BTC.

Even if the allowed precision is expanded from the current 8 decimals, the total BTC in circulation will always be slightly below 21 million (assuming everything else stays the same). For example, with 16 decimals of precision, the end total would be 20,999,999.999999999496 BTC.

Dacă nu mai sunt generate monezi, se vor mai crea block-uri?

Absolutely! Even before the creation of coins ends, the use of transaction fees will likely make creating new blocks more valuable from the fees than the new coins being created. When coin generation ends, these fees will sustain the ability to use bitcoins and the Bitcoin network. There is no practical limit on the number of blocks that will be mined in the future.

Dar dacă nu mai sunt generate monezi, ce se întâmplă când se pierd bitcoini? Nu ar fi o problemă?

Because of the law of supply and demand, when fewer bitcoins are available the ones that are left will be in higher demand, and therefore will have a higher value. So, as Bitcoins are lost, the remaining bitcoins will eventually increase in value to compensate. As the value of a bitcoin increases, the number of bitcoins required to purchase an item decreases. This is a deflationary economic model. As the average transaction size reduces, transactions will probably be denominated in sub-units of a bitcoin such as millibitcoins ("Millies") or microbitcoins ("Mikes").

The Bitcoin protocol uses a base unit of one hundred-millionth of a Bitcoin ("a Satoshi"), but unused bits are available in the protocol fields that could be used to denote even smaller subdivisions.

Dacă fiecare tranzacție este emisă prin rețea, atunci este Bitcoin scalabil?

The Bitcoin protocol allows lightweight clients that can use Bitcoin without downloading the entire transaction history. As traffic grows and this becomes more critical, implementations of the concept will be developed. Full network nodes will at some point become a more specialized service.

With some modifications to the software, full Bitcoin nodes could easily keep up with both VISA and MasterCard combined, using only fairly modest hardware (a single high end server by todays standards). It is worth noting that the MasterCard network is structured somewhat like Bitcoin itself - as a peer to peer broadcast network.

Learn more about Scalability.

Economie

Where does the value of Bitcoin stem from? What backs up Bitcoin?

Bitcoins have value because they are useful and because they are scarce. As they are accepted by more merchants, their value will stabilize. See the list of Bitcoin-accepting sites.

When we say that a currency is backed up by gold, we mean that there's a promise in place that you can exchange the currency for gold. Bitcoins, like dollars and euros, are not backed up by anything except the variety of merchants that accept them.

It's a common misconception that Bitcoins gain their value from the cost of electricity required to generate them. Cost doesn't equal value – hiring 1,000 men to shovel a big hole in the ground may be costly, but not valuable. Also, even though scarcity is a critical requirement for a useful currency, it alone doesn't make anything valuable. For example, your fingerprints are scarce, but that doesn't mean they have any exchange value.

Alternatively it needs to be added that while the law of supply and demand applies it does not guarantee value of Bitcoins in the future. If confidence in Bitcoins is lost then it will not matter that the supply can no longer be increased, the demand will fall off with all holders trying to get rid of their coins. An example of this can be seen in cases of state currencies, in cases when the state in question dissolves and so no new supply of the currency is available (the central authority managing the supply is gone), however the demand for the currency falls sharply because confidence in its purchasing power disappears. Of-course Bitcoins do not have such central authority managing the supply of the coins, but it does not prevent confidence from eroding due to other situations that are not necessarily predictable.

Este Bitcoin o bula?

Yes, in the same way as the euro and dollar are. They only have value in exchange and have no inherent value. If everyone suddenly stopped accepting your dollars, euros or bitcoins, the "bubble" would burst and their value would drop to zero. But that is unlikely to happen: even in Somalia, where the government collapsed 20 years ago, Somali shillings are still accepted as payment.

Este Bitcoin o schemă piramidală/Ponzi?

In a Ponzi Scheme, the founders persuade investors that they’ll profit. Bitcoin does not make such a guarantee. There is no central entity, just individuals building an economy.

A ponzi scheme is a zero sum game. Early adopters can only profit at the expense of late adopters. Bitcoin has possible win-win outcomes. Early adopters profit from the rise in value. Late adopters, and indeed, society as a whole, benefit from the usefulness of a stable, fast, inexpensive, and widely accepted p2p currency.

The fact that early adopters benefit more doesn't alone make anything a Ponzi scheme. All good investments in successful companies have this quality.

Nu cumva Bitcoin favorizează pe nedrept investitorii inițiali?

Early adopters have a large number of bitcoins now because they took a risk and invested resources in an unproven technology. By so doing, they have helped Bitcoin become what it is now and what it will be in the future (hopefully, a ubiquitous decentralized digital currency). It is only fair they will reap the benefits of their successful investment.

In any case, any bitcoin generated will probably change hands dozens of time as a medium of exchange, so the profit made from the initial distribution will be insignificant compared to the total commerce enabled by Bitcoin.

Since the pricing of Bitcoins has fallen greatly from its June 2011 peak, prices today are much more similar to those enjoyed by many early adopters. Those who are buying Bitcoins today likely believe that Bitcoin will grow significantly in the future. Setting aside the brief opportunity to have sold Bitcoins at the June 2011 peak enjoyed by few, the early-adopter window is arguably still open.

Pierderea de portofele și faptul că numărul de bitcoini este finit nu ar cauza deflație excesivă, distrugând Bitcoinul?

Worries about Bitcoin being destroyed by deflation are not entirely unfounded. Unlike most currencies, which experience inflation as their founding institutions create more and more units, Bitcoin will likely experience gradual deflation with the passage of time. Bitcoin is unique in that only a small amount of units will ever be produced (twenty-one million to be exact), this number has been known since the project's inception, and the units are created at a predictable rate.

Also, Bitcoin users are faced with a danger that doesn't threaten users of any other currency: if a Bitcoin user loses his wallet, his money is gone forever, unless he finds it again. And not just to him; it's gone completely out of circulation, rendered utterly inaccessible to anyone. As people will lose their wallets, the total number of Bitcoins will slowly decrease.

Therefore, Bitcoin seems to be faced with a unique problem. Whereas most currencies inflate over time, Bitcoin will mostly likely do just the opposite. Time will see the irretrievable loss of an ever-increasing number of Bitcoins. An already small number will be permanently whittled down further and further. And as there become fewer and fewer Bitcoins, the laws of supply and demand suggest that their value will probably continually rise.

Thus Bitcoin is bound to once again stray into mysterious territory, because no one exactly knows what happens to a currency that grows continually more valuable. Many economists claim that a low level of inflation is a good thing for a currency, but nobody is quite sure about what might happens to one that continually deflates. Although deflation could hardly be called a rare phenomenon, steady, constant deflation is unheard of. There may be a lot of speculation, no one has any hard data to back up their claims.

That being said, there is a mechanism in place to combat the obvious consequences. Extreme deflation would render most currencies highly impractical: if a single Canadian dollar could suddenly buy the holder a car, how would one go about buying bread or candy? Even pennies would fetch more than a person could carry. Bitcoin, however, offers a simple and stylish solution: infinite divisibility. Bitcoins can be divided up and trade into as small of pieces as one wants, so no matter how valuable Bitcoins become, one can trade them in practical quantities.

In fact, infinite divisibility should allow Bitcoins to function in cases of extreme wallet loss. Even if, in the far future, so many people have lost their wallets that only a single Bitcoin, or a fraction of one, remains, Bitcoin should continue to function just fine. No one can claim to be sure what is going to happen, but deflation may prove to present a smaller threat than many expect.

For more information, see the Deflationary spiral page.

Dar dacă cineva ar cumpăra fiecare bitcoin existent?

Bitcoin markets are competitive -- meaning the price of a bitcoin will rise or fall depending on supply and demand at certain price levels. Only a fraction of bitcoins issued to date are found on the exchange markets for sale. So even though technically a buyer with lots of money could buy all the bitcoins offered for sale, unless those holding the rest of the bitcoins offer them for sale as well, even the wealthiest, most determined buyer can't get at them.

Additionally, new currency continues to be issued daily and will continue to do so for decades though over time the rate at which they are issued declines to insignificant levels. Those who are mining aren't obligated to sell their bitcoins so not all bitcoins will make it to the markets even.

This situation doesn't suggest, however, that the markets aren't vulnerable to price manipulation. It doesn't take significant amounts of money to move the market price up or down and thus Bitcoin remains a volatile asset.

Dacă cineva creează un nou lanț de blocuri (block chain), sau o nouă monedă digitală care scoate Bitcoinul din uz?

That the block chain cannot be easily forked represents one of the central security mechanisms of Bitcoin. Given the choice between two block chains, a Bitcoin miner always chooses the longer one - that is to say, the one with the more complex hash. Thusly, it ensures that each user can only spend their bitcoins once, and that no user gets ripped off.

As a consequence of the block chain structure, there may at any time be many different sub-branches, and the possibility always exists of a transaction being over-written by the longest branch, if it has been recorded in a shorter one. The older a transaction is though, the lower its chances of being over-written, and the higher of becoming permanent. Although the block chain prevents one from spending more Bitcoins than one has, it means that transactions can be accidentally nullified.

A new block chain would leave the network vulnerable to double-spend attacks. However, the creation of a viable new chain presents considerable difficulty, and the possibility does not present much of a risk.

Bitcoin will always choose the longer Block Chain and determines the relative length of two branches by the complexities of their hashes. Since the hash of each new block is made from that of the block preceding it, to create a block with a more complex hash, one must be prepared to do more computation than has been done by the entire Bitcoin network from the fork point up to the newest of the blocks one is trying to supersede. Needless to say, such an undertaking would require a very large amount of processing power and since Bitcoin is continually growing and expanding, it will likely only require more with the passage of time.

A much more distinct and real threat to the Bitcoin use is the development of other, superior virtual currencies, which could supplant Bitcoin and render it obsolete and valueless.

A great deal of careful thought and ingenuity has gone into the development of Bitcoin, but it is the first of its breed, a prototype, and vulnerable to more highly-evolved competitors. At present, any threatening rivals have yet to rear their heads; Bitcoin remains the first and foremost private virtual currency, but we can offer no guarantees that it will retain that position. It would certainly be in keeping with internet history for a similar system built from the same principles to supersede and cast Bitcoin into obsolescence, after time had revealed its major shortcomings. Friendster and Myspace suffered similar fates at the hand of Facebook, Napster was ousted by Limeware, Bearshare and torrent applications, and Skype has all but crushed the last few disciples of the Microsoft Messenger army.

This may sound rather foreboding, so bear in mind that the introduction of new and possibly better virtual currencies will not necessarily herald Bitcoin's demise. If Bitcoin establishes itself sufficiently firmly before the inception of the next generation of private, online currencies so as to gain widespread acceptance and general stability, future currencies may pose little threat even if they can claim superior design. This is known as the network effect.

Este Bitcoin susceptibil manipulării valorii sale?

The current low market cap of Bitcoin means that any investor with deep enough pockets can significantly change/manipulate the rate. Is this a problem?

This is only a problem if you are investing in Bitcoin for short period of time. A manipulator can't change the fundamentals, and over a period of 5-10 years they will win over any short term manipulations.

Efectuarea și primirea de plăți

De ce trebuie să aștept 10 minute înainte să pot cheltui banii primiți?

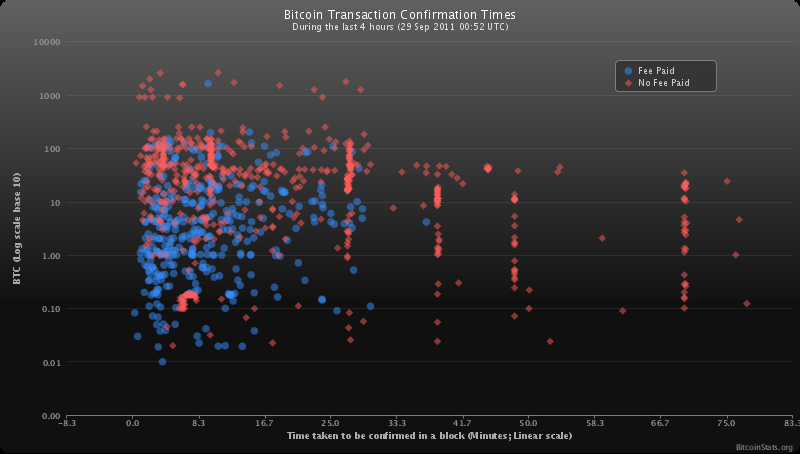

10 minutes is the average time taken to find a block. It can be significantly more or less time than that depending on luck; 10 minutes is simply the average case.

You can see how long all other recent transactions have taken here: BitcoinStats.org.

Blocks (shown as "confirmations" in the GUI) are how the Bitcoin achieves consensus on who owns what. Once a block is found everyone agrees that you now own those coins, so you can spend them again. Until then it's possible that some network nodes believe otherwise, if somebody is attempting to defraud the system by reversing a transaction. The more confirmations a transaction has, the less risk there is of a reversal. Only 6 blocks or 1 hour is enough to make reversal computationally impractical. This is dramatically better than credit cards which can see chargebacks occur up to three months after the original transaction!

Ten minutes was specifically chosen by Satoshi as a tradeoff between propagation time of new blocks in large networks and the amount of work wasted due to chain splits. For a more technical explanation, see Satoshi's original technical paper.

Do you have to wait until my transactions are confirmed in order to buy or sell things with Bitcoin?

YES, you do, IF the transaction is non-recourse. The Bitcoin reference software does not display transactions as confirmed until six blocks have passed (confirmations). As transactions are burred in the chain they become increasingly non-reversible but are very reversible before the first confirmation. Two to six confirmations are recommended for non-recourse situations depending on the value of the transactions involved.

When people ask this question they are usually thinking about applications like supermarkets. This generally is a recourse situation: if somebody tries to double-spend on a face-to-face transaction it might work a few times, but probabalistically speaking eventually one of the double-spends will get noticed, and the penalty for shoplifting charges in most localities is calibrated to be several times worse than the proceeds of a single shoplifting event.

Double-spends might be a concern for something like a snack machine in a low-traffic area with no nearby security cameras. Such a machine shouldn't honor 0-confirmation payments, and should instead use some other mechanism of clearing Bitcoin or validating transactions against reversal, see the wiki article here for alternatives.

Applications that require immediate payment processing, like supermarkets or snack machines, need to manage the risks. Here is one way to reverse an unconfirmed payment:

A Finney attack, in which an attacker mines a block containing a movement of some coins back to themselves. Once they find a block solution, they quickly go to a merchant and make a purchase, then broadcast the block, thus taking back the coins. This attack is a risk primarily for goods that are dispatched immediately, like song downloads or currency trades. Because the attacker can't choose the time of the attack, it isn't a risk for merchants such as supermarkets where you can't choose exactly when to pay (due to queues, etc). The attack can fail if somebody else finds a block containing the purchasing transaction before you release your own block, therefore, merchants can reduce but not eliminate the risk by making purchasers wait some length of time that's less than a confirm.

Because pulling off this attack is not trivial, merchants who need to sell things automatically and instantly are most likely to just price the cost of reversal fraud in, or use insurance.

I was sent some bitcoins and they haven't arrived yet! Where are they?

Don't panic! There are a number of reasons why your bitcoins might not show up yet, and a number of ways to diagnose them.

The latest version of the Bitcoin-Qt client tells you how far it has yet to go in downloading the blockchain. Hover over the icon in the bottom right corner of the client to learn your client's status.

If it has not caught up then it's possible that your transaction hasn't been included in a block yet.

You can check pending transactions in the network by going here and then searching for your address. If the transaction is listed here then it's a matter of waiting until it gets included in a block before it will show in your client.

If the transaction is based on a coin that was in a recent transaction then it could be considered a low priority transaction. Transfers can take longer if the transaction fee paid was not high enough. If there is no fee at all the transfer can get a very low priority and take hours or even days to be included in a block.

Why does my Bitcoin address keep changing?

Whenever the address listed in "Your address" receives a transaction, Bitcoin replaces it with a new address. This is meant to encourage you to use a new address for every transaction, which enhances anonymity. All of your old addresses are still usable: you can see them in Settings -> Your Receiving Addresses.

How much will the transaction fee be?

Some transactions might require a transaction fee for them to get confirmed in a timely manner. The transaction fee is processed by and received by the bitcoin miner. The most recent version of the Bitcoin client will estimate an appropriate fee when a fee might be required.

The fee is added to the payment amount. For example, if you are sending a 1.234 BTC payment and the client requires a 0.0005 BTC fee, then 1.2345 BTC will be subtracted from the wallet balance for the entire transaction and the address for where the payment was sent will receive a payment of 1.234 BTC.

A fee might be imposed because your transaction looks like a denial of service attack to the Bitcoin system. For example, it might be burdensome to transmit or it might recycle Bitcoins you recently received. The wallet software attempts to avoid generating burdensome transactions, but it isn't always able to do so: The funds in your wallet might be new or composed of many tiny payments.

Because the fee is related to the amount of data that makes up the transaction and not to the amount of Bitcoins being sent, the fee may seem extremely low (0.0005 BTC for a 1,000 BTC transfer) or unfairly high (0.004 BTC for a 0.02 BTC payment, or about 20%). If you are receiving tiny amounts (e.g. as small payments from a mining pool) then fees when sending will be higher than if your activity follows the pattern of conventional consumer or business transactions.

As of Bitcoin 0.5.3 the required fee will not be higher than 0.05 BTC. For most users there is usually no required fee at all. If a fee is required it will most commonly be 0.0005 BTC.

What happens when someone sends me a bitcoin but my computer is powered off?

Bitcoins are not actually "sent" to your wallet; the software only uses that term so that we can use the currency without having to learn new concepts. Your wallet is only needed when you wish to spend coins that you've received.

If you are sent coins when your wallet client program is not running, and you later launch the wallet client program, the coins will eventually appear as if they were just received in the wallet. That is to say, when the client program is started it must download blocks and catch up with any transactions it did not already know about.

How long does "synchronizing" take when the Bitcoin client is first installed? What's it doing?

The popular Bitcoin client software from bitcoin.org implements a "full" Bitcoin node: It can carry out all the duties of the Bitcoin P2P system, it isn't simply a "client". One of the principles behind the operation of full Bitcoin nodes is that they don't assume that the other participants have followed the rules of the Bitcoin system. During synchronization, the software is processing historical Bitcoin transactions and making sure for itself that all of the rules of the system have been correctly followed.

In normal operation, after synchronizing, the software should use a hardly noticeable amount of your computer's resources.

When the wallet client program is first installed, its initial validation requires a lot of work from your computer's hard disk, so the amount of time to synchronize depends on your disk speed and, to a lesser extent, your CPU speed. It can take anywhere from a few hours to a day or so. On a slow computer it could take more than 40 hours of continuous synchronization, so check your computer's power-saving settings to ensure that it does not turn its hard disk off when unattended for a few hours. You can use the Bitcoin software during synchronization, but you may not see recent payments to you until the client program has caught up to the point where those transactions happened.

If you feel that this process takes too long, you can download a pre-synchronized blockchain from http://eu2.bitcoincharts.com/blockchain/. Alternatively, you can try an alternative "lite" client such as Multibit or a super-light client like electrum, though these clients have somewhat weaker security, are less mature, and don't contribute to the health of the P2P network.

Networking

Do I need to configure my firewall to run Bitcoin?

Bitcoin will connect to other nodes, usually on TCP port 8333. You will need to allow outgoing TCP connections to port 8333 if you want to allow your Bitcoin client to connect to many nodes. Testnet uses TCP port 18333 instead of 8333.

If you want to restrict your firewall rules to a few IPs, you can find stable nodes in the fallback nodes list.

How does the peer finding mechanism work?

Bitcoin finds peers primarily by forwarding peer announcements within its own network and each node saves a database of peers that it's aware of, for future use. In order to bootstrap this process Bitcoin needs a list of initial peers, these can be provided manually but normally it obtains them by querying a set of DNS domain names which have automatically updated lists, if that doesn't work it falls back to a built-in list which is updated from time to time in new versions of the software. There is also an IRC based mechanism but it is disabled by default.

Mining

What is mining?

Mining is the process of spending computation power to secure Bitcoin transactions against reversal and introducing new Bitcoins to the system.

Technically speaking, mining is the calculation of a hash of the a block header, which includes among other things a reference to the previous block, a hash of a set of transactions and a nonce. If the hash value is found to be less than the current target (which is inversely proportional to the difficulty), a new block is formed and the miner gets the newly generated Bitcoins (25 per block at current levels). If the hash is not less than the current target, a new nonce is tried, and a new hash is calculated. This is done millions of times per second by each miner.

Is mining used for some useful computation?

The computations done when mining are internal to Bitcoin and not related to any other distributed computing projects. They serve the purpose of securing the Bitcoin network, which is useful.

Is it not a waste of energy?

Spending energy on creating and securing a free monetary system is hardly a waste. Also, services necessary for the operation of currently widespread monetary systems, such as banks and credit card companies, also spend energy, arguably more than Bitcoin would.

Why don't we use calculations that are also useful for some other purpose?

To provide security for the Bitcoin network, the calculations involved need to have some very specific features. These features are incompatible with leveraging the computation for other purposes.

How can we stop miners from creating zero transaction blocks?

The incentive for miners to include transactions is in the fees that come along with them. If we were to implement some minimum number of transactions per block it would be trivial for a miner to create and include transactions merely to surpass that threshold. As the network matures, the block reward drops, and miners become more dependent on transactions fees to pay their costs, the problem of zero transaction blocks should diminish over time.

How does the proof-of-work system help secure Bitcoin?

To give a general idea of the mining process, imagine this setup:

payload = <some data related to things happening on the Bitcoin network> nonce = 1 hash = SHA2( SHA2( payload + nonce ) )

The work performed by a miner consists of repeatedly increasing "nonce" until the hash function yields a value, that has the rare property of being below a certain target threshold. (In other words: The hash "starts with a certain number of zeroes", if you display it in the fixed-length representation, that is typically used.)

As can be seen, the mining process doesn't compute anything special. It merely tries to find a number (also referred to as nonce) which - in combination with the payload - results in a hash with special properties.

The advantage of using such a mechanism consists of the fact, that it is very easy to check a result: Given the payload and a specific nonce, only a single call of the hashing function is needed to verify that the hash has the required properties. Since there is no known way to find these hashes other than brute force, this can be used as a "proof of work" that someone invested a lot of computing power to find the correct nonce for this payload.

This feature is then used in the Bitcoin network to secure various aspects. An attacker that wants to introduce malicious payload data into the network, will need to do the required proof of work before it will be accepted. And as long as honest miners have more computing power, they can always outpace an attacker.

Also see Hashcash and Proof-of-work system and SHA2 and on Wikipedia.

Why was the "Generate coin" option of the client software removed?

In the early days of Bitcoin, it was easy for anyone to find new blocks using standard CPUs. As more and more people started mining, the difficulty of finding new blocks has greatly increased to the point where the average time for a CPU to find a single block can be many years. The only cost-effective method of mining is using a high-end graphics card with special software (see also Why a GPU mines faster than a CPU) and/or joining a mining pool. Since solo CPU mining is essentially useless, it was removed from the GUI of the Bitcoin software.

Security

Could miners collude to give themselves money or to fundamentally change the nature of Bitcoin?

There are two questions in here. Let's look at them separately.

- Could miners gang up and give themselves money?

Mining itself is the process of creating new blocks in the block chain. Each block contains a list of all the transactions that have taken place across the entire Bitcoin network since the last block was created, as well as a hash of the previous block. New blocks are 'mined', or rather, generated, by Bitcoin clients correctly guessing sequences of characters in codes called 'hashes,' which are created using information from previous blocks. Bitcoin users may download specialized 'mining' software, which allows them to dedicate some amount of their processing power – however large or small – to guessing at strings within the hash of the previous block. Whoever makes the right guess first, thus creating a new block, receives a reward in Bitcoins.

The block chain is one of the two structures that makes Bitcoin secure, the other being the public-key encryption system on which Bitcoin trade is based. The block chain assures that not only is every single transaction that ever takes place recorded, but that every single transaction is recorded on the computer of anyone who chooses to store the relevant information. Many, many users have complete records of every transaction in Bitcoins history readily available to them at any point, and anyone who wants in the information can obtain it with ease. These things make Bitcoin very hard to fool.

The Bitcoin network takes considerable processing power to run, and since those with the most processing power can make the most guesses, those who put the most power toward to sustaining the network earn the most currency. Each correct guess yields, at present, twenty-five Bitcoins, and as Bitcoins are presently worth something (although the value still fluctuates) every miner who earns any number of Bitcoins makes money. Some miners pull in Bitcoins on their own; and some also join or form pools wherein all who contribute earn a share of the profits.

Therefore, first answer is a vehement “yes” – not only can miners collude to get more money, Bitcoin is designed to encourage them to do so. Bitcoin pools are communal affairs, and there is nothing dishonest or underhanded about them.

Of course, the real question is:

- Can they do so in ways not sanctioned by Bitcoin developers? Is there any way to rip off the network and make loads of money dishonestly?

Bitcoin isn't infallible. It can be cheated, but doing so is extremely difficult. Bitcoin was designed to evade some of the central problems with modern currencies – namely, that their trustworthiness hinges upon that of people who might not have users' best interests in mind. Every currency in the world (other than Bitcoin) is controlled by large institutions who keep track of what's done with it, and who can manipulate its value. And every other currency has value because people trust the institutions that control them.

Bitcoin doesn't ask that its users trust any institution. Its security is based on the cryptography that is an integral part of its structure, and that is readily available for any and all to see. Instead of one entity keeping track of transactions, the entire network does, so Bitcoins are astoundingly difficult to steal, or double-spend. Bitcoins are created in a regular and predictable fashion, and by many different users, so no one can decide to make a whole lot more and lessen their value. In short, Bitcoin is designed to be inflation-proof, double-spend-proof and completely distributed.

Nonetheless, there are a few ways that one can acquire Bitcoins dishonestly. Firstly, one can steal private keys. Key theft isn't something that Bitcoin security has been designed to prevent: it's up to users to keep theirs safe. But the cryptography is designed so that it is completely impossible to deduce someone's private key from their public one. As long as you keep your private key to yourself, you don't have much to worry about. Furthermore, one could theoretically create a new block chain, but due to the way in which the block chain is constructed, this would be extremely difficult and require massive amounts of processing power. A full explanation of the difficulties involved can be found in the block chain article.

Bitcoin can be ripped off – but doing so would be extremely hard and require considerable expertise and a staggering amount of processing power. And it's only going to get harder with time. Bitcoin isn't impenetrable, but it's close enough to put any real worries in the peripherals.

- Could miners fundamentally change the nature of Bitcoin?

Once again, almost certainly not.

Bitcoin is a distributed network, so any changes implemented to the system must be accepted by all users. Someone trying to change the way Bitcoins are generated would have to convince every user to download and use their software – so the only changes that would go through are those that would be equally benefit all users.

And thus, it is more or less impossible for anyone to change the function of Bitcoin to their advantage. If users don't like the changes, they won't adopt them, whereas if users do like them, then these will help everyone equally. Of course, one can conceive of a situation where someone manages to get a change pushed through that provides them with an advantage that no one notices, but given that Bitcoin is structurally relatively simple, it is unlikely that any major changes will go through without someone noticing first.

The fact that such changes are so difficult to make testifies to the fully distributed nature of Bitcoin. Any centrally controlled currency can be modified by its central agency without the consent of its adherents. Bitcoin has no central authority, so it changes only at the behest of the whole community. Bitcoins development represents a kind of collective evolution; the first of its kind among currencies.

Ajutor

As vrea sa aflu mai multe. Unde as putea gasi mai multe informatii?

- Cititi introducerea

- See the videos, podcasts, and blog posts from the Press

- Cititi si postati pe Bitcointalk.org Romania

- Accesati canalele IRC Bitcoin

- Vizitati si dati un Like paginii Bitcoin Romania